Harrisonville, in Cass County, has three local tax and bond issues on the November 4 ballot. This being a November in an odd-numbered year, turnout will likely be low (probably intentionally).

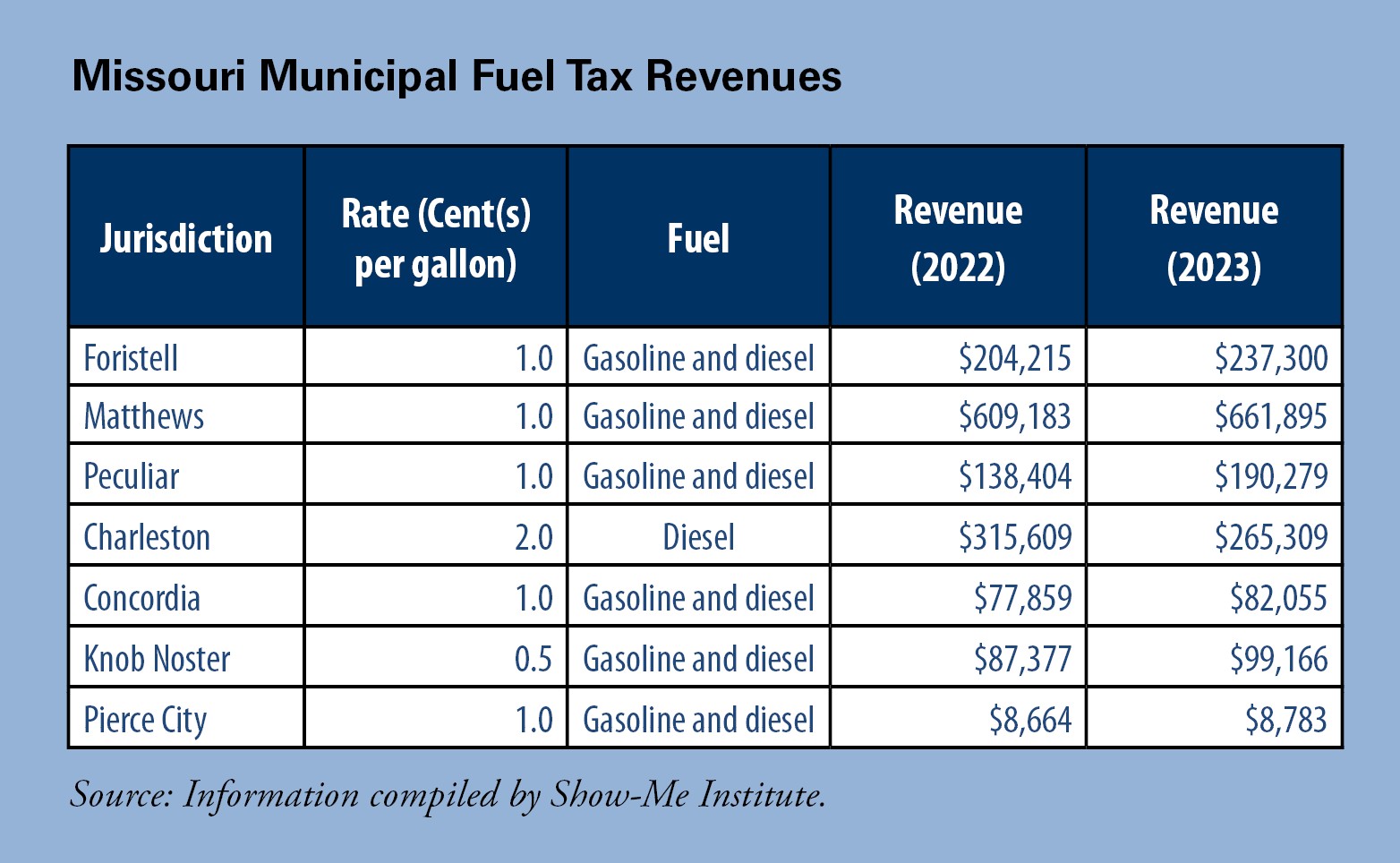

The most interesting tax issue on the Harrisonville ballot is a local gas tax. Local gas taxes are a little-used option for funding roads for municipalities. Harrisonville would be the eighth city in Missouri to enact such a tax for its roads, according to Show-Me Institute research. Not surprisingly, many of these municipalities are located along major highways where people frequently stop for gas. In the same way that Prussia was called “an army with a country,” Foristell and Matthews could be considered truck stops with their own cities.

Local gas taxes require a 60 percent threshold for voter approval. The funds raised by the tax can only be spent on roads within the city. Obviously, getting 60 percent of the vote for any new tax is difficult, and that is likely one reason local gas taxes are so rare. Foristell, for example, needed multiple attempts before voters approved its gas tax.

Funding roads with user taxes like a gas tax is good public policy, and this includes local roads. It is smart policy to connect the cost of driving with the act of driving as much as possible. When you pay for roads with unrelated taxes, such as a property tax, a general transportation sales tax, or a targeted transportation development district (TDD) sales tax (which sounds like a transportation tax but is often just a form of corporate welfare), you subsidize increased driving by lowering the relative cost of driving.

As electric vehicles become more common, adjustments to the gas tax system will have to be made. But in the short term, more cities should consider adopting very low gas taxes in order to fund local roads. This table has more information on the local gas taxes implemented by Missouri cities:

While not every municipality can raise hundreds of thousands of dollars a year, it is worth considering in any municipality with a gas station. Similarly, the state should consider lowering the threshold for voter approval of local gas taxes to the standard 50 percent plus one.

The other two taxes and bonds being considered are much less beneficial. Harrisonville already has a local sales tax rate of 2.375%, and it is asking voters to raise it another 0.25%. However, the ballot wording is very confusing. The ballot says, “Shall the city of Harrisonville, Missouri impose a city sales tax of one and one quarter of a percent?” That would seemingly indicate a tax increase of 1.25%. However, the city website says it is only a 0.25% increase, leading to a total tax of 1.25%. But that conflicts with the other city website (link above), which lists the city sales tax at 2.375%. It may be that the city general sales tax is being increased, but then the city is clearly misleading voters as to the current sales tax rate by saying it is just 1% when it is 2.375%.

This sales tax rate increase is particularly high considering that Harrisonville also levies a moderately high property tax rate. Other cities with extremely high sales taxes tend to have very low property tax rates, such as Ashland. Whether they want the tax increase or not, Harrisonville residents should know they are living in a city with very high total municipal taxes. In particular, Harrisonville should remove some of its 1% TDD sales taxes, which would make its local sales tax almost 5%, if voters approve the tax increase.

Finally, voters are being asked to approve a bond issue for the Harrisonville municipal water and sewer system. This blog post is long enough, but suffice it to say residents of Harrisonville would be better served by privatizing their municipal utilities instead of continuing to go further into debt for them.